Despite increased costs and high interest rates, U.S. households have not been deterred from spending their money. According to the Bureau of Economic Analysis, consumer spending in the U.S. increased by 24.1% from the first quarter of 2021 to the last quarter of 2023, which in turn, led to a notable uptick in credit usage.

Total credit card debt in the U.S. surpassed $1 trillion for the first time in 2022, and throughout that year, card issuers levied over $130 billion in interest and fees. This equates to more than $1,000 in credit card interest and fees per U.S. household. However, variations in consumer credit utilization and their propensity to accrue interest—most commonly by not paying off their bill in full each month—have created disparities among states. Because of this, certain states are experiencing the impact of elevated interest rates more than others.

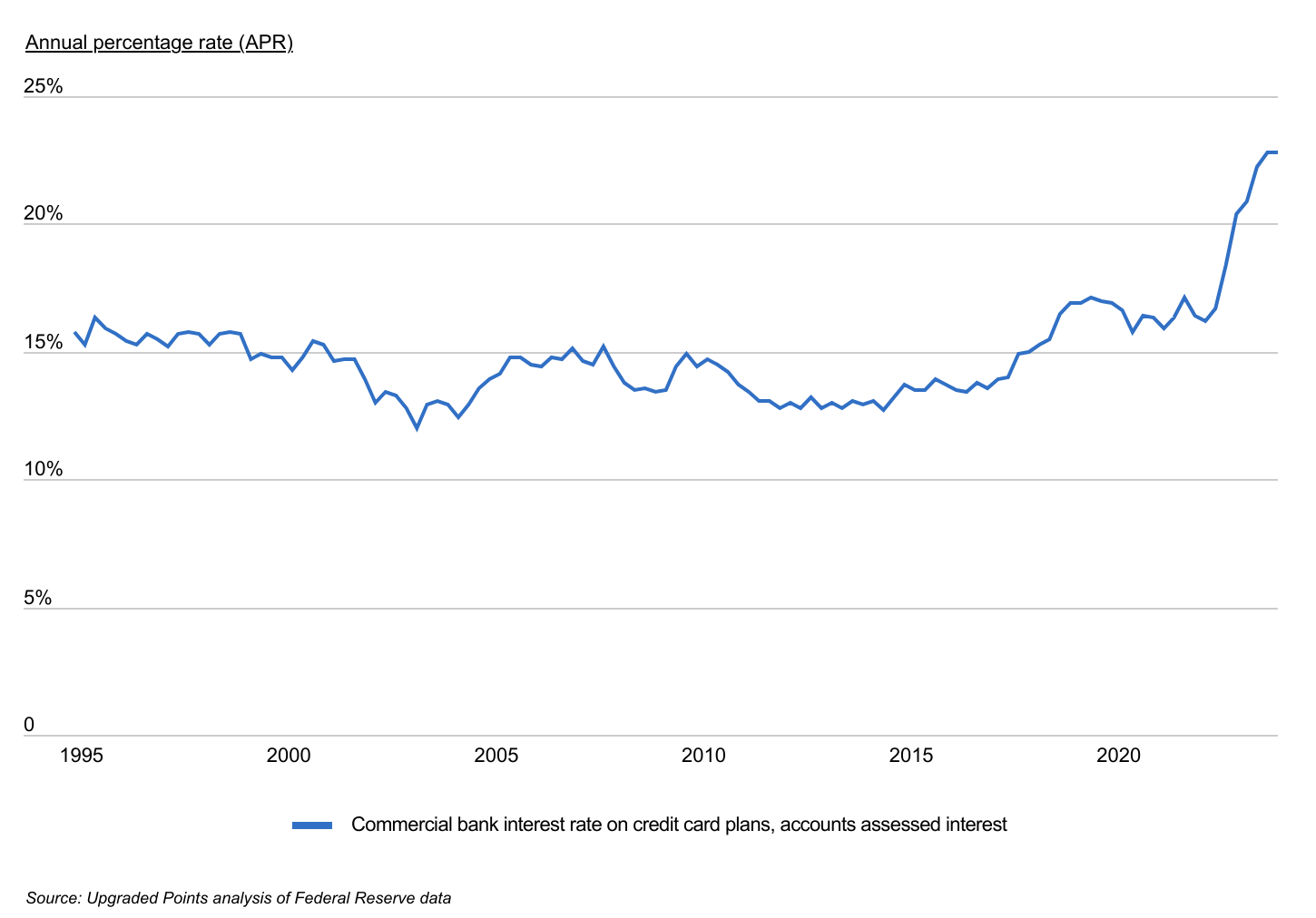

Credit Card Interest Rate Trends

In 2023, interest rates on credit card accounts skyrocketed to historic levels. Image Credit: Upgraded Points

This past year saw typical credit card interest rates soar to historic levels, which puts even greater pressure on households relying heavily on credit. From the beginning of 2022 to the end of 2023, credit card APRs spiked from 16.6% to 22.8%, their highest level dating back to at least the mid-1990s. For credit card users who do not settle their balances in full each month, these elevated interest rates can lead to a rapid compounding of the total amount owed.

For example, an individual with $10,000 in credit card debt at a 16% rate, opting to make only the minimum monthly payment, could accrue nearly $13,000 in interest by the time the debt is fully paid off. At a 23% rate, that same individual could pay over $18,000 in interest.

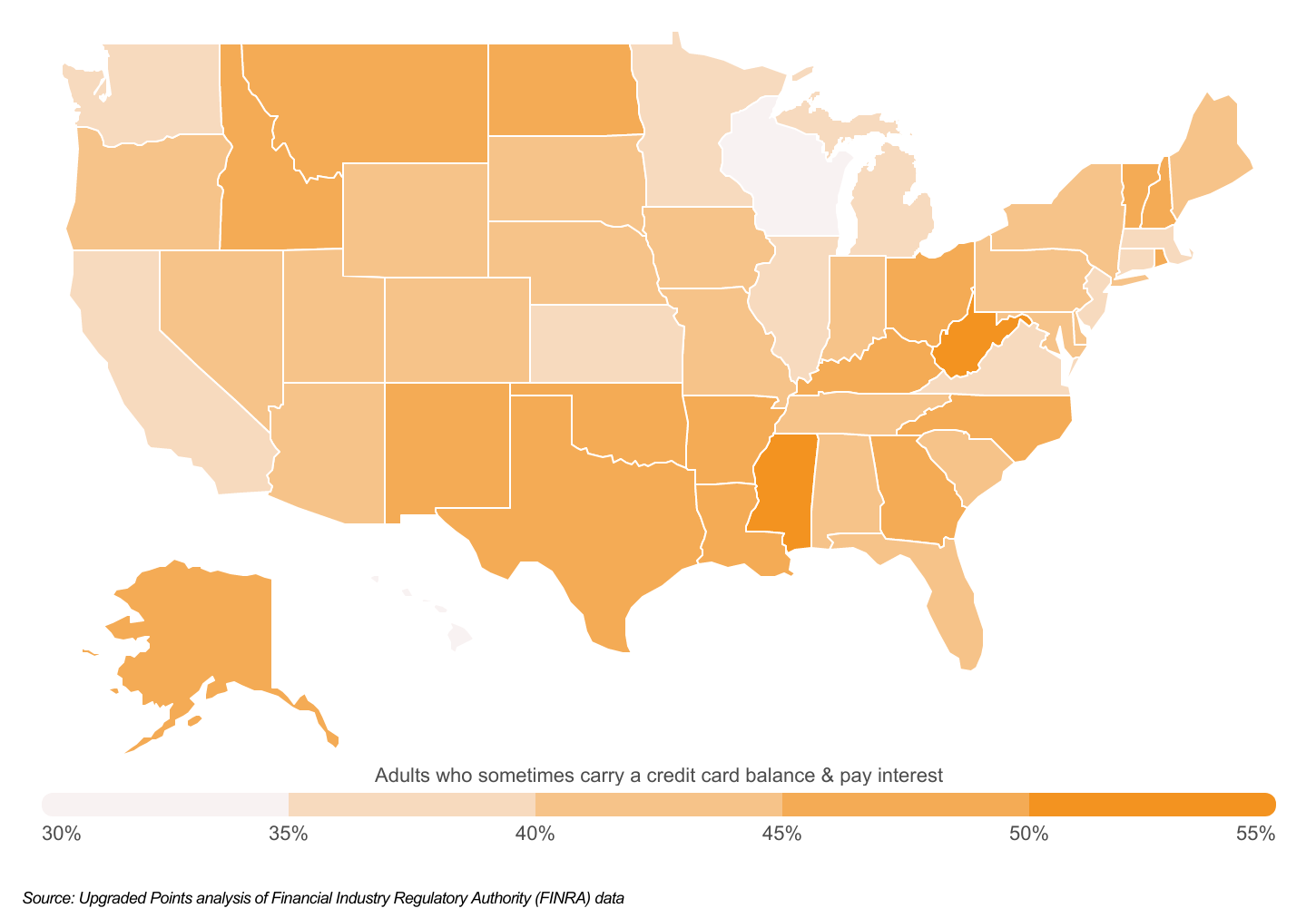

States With the Most Adults Who Carry a Credit Card Balance

More than half of adults in West Virginia & Mississippi sometimes carry a credit card balance and pay interest. Image Credit: Upgraded Points

Unfortunately, carrying a credit card balance from month to month is more common than one might expect given the high cost of doing so. Nationally, nearly 43% of adults acknowledge occasionally carrying a balance and incurring interest on their credit cards—an audience that stands to gain the most from a reduction in credit card rates.

This pattern is notably widespread in regions of the South and West, where substantial proportions of adults admit to not paying their credit card bills in full each month. In West Virginia and Mississippi, for instance, over half of all credit card holders carry balances and accrue interest. Similar patterns persist in Alaska, Arkansas, Montana, Oklahoma, and Texas, where at least 48% of cardholders maintain balances. It’s also common for residents in these states to engage in other costly credit card behaviors, such as only making the minimum monthly payment on their bill, paying their bill late, or using their cards for cash advances.

On the other hand, cardholders in the Northeast, Midwest, and Hawaii are the least likely to accrue credit card interest given their high propensity to pay their bills off completely (and on time) each month. In Hawaii for instance, less than a third of residents carry a credit card balance.

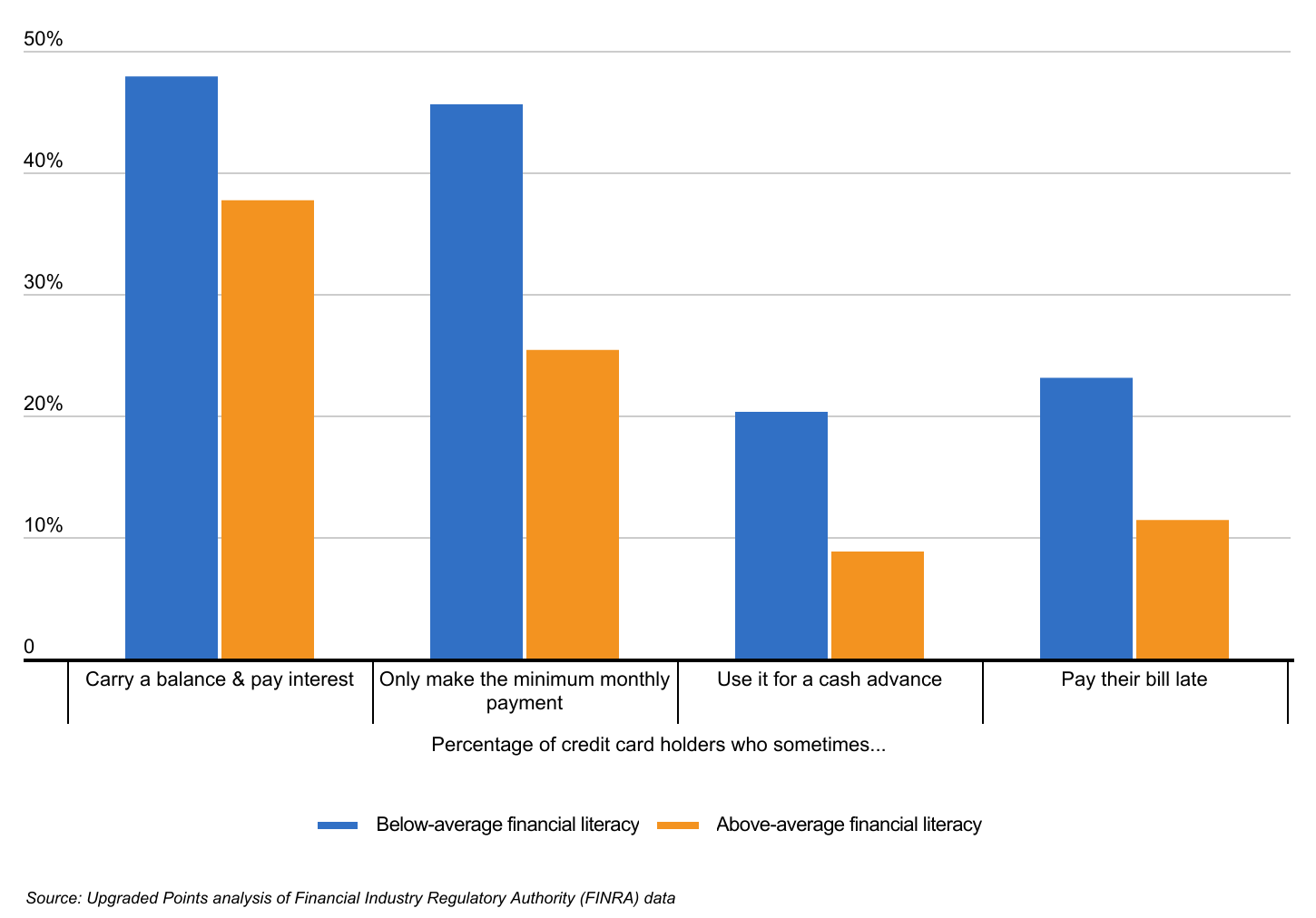

Credit Card Behaviors That Lead to High Fees & Interest

Americans with high financial literacy are less likely to incur credit card fees and interest. Image Credit: Upgraded Points

There are significant differences among cardholders in how they use credit and handle their balances. One of the factors that impacts this is financial literacy. According to data from FINRA, credit card holders with below-average financial literacy are 10 percentage points more likely to carry a balance and pay interest than those with above-average financial literacy. They are also nearly twice as likely to only make a minimum monthly payment and more than twice as likely to use their card for a cash advance and to pay their credit card bill late.

Below is a complete breakdown of all 50 states. The research was conducted by Upgraded Points using the latest data from the Financial Industry Regulatory Authority (FINRA). For more details on how the analysis was conducted, refer to the methodology below.

Methodology

Photo Credit: Cast Of Thousands / Shutterstock

Data sources included FINRA’s 2021 National Financial Capability Study (NFCS) and Experian’s 2023 Average FICO Score by State. To determine which states would benefit most from credit card interest rate declines, Upgraded Points calculated the percentage of survey respondents in each state who reported sometimes carrying a credit card balance, and subsequently paying interest. In the event of a tie, the state with the higher percentage of respondents who reported sometimes only making the minimum credit card payment was ranked higher. Only survey respondents that hold at least one credit card were included.

For complete results, see States That Would Benefit Most From Credit Card Interest Rate Declines on Upgraded Points.